Bottom Fishing: Vornado’s Actions Speak Louder Than Words

Vornado have insisted that they aren’t calling a bottom for New York. Their stock is a different story.

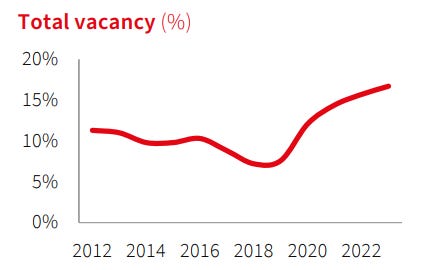

The reports of New York commercial real estate’s death have… not been exaggerated at all, actually. If you’re anything like me, seeing the latest and greatest headlines are a good enough excuse to start popping Pepto-Bismol. It’s dire! JLL puts Class A office vacancy >15% and net absorption is expected to be negative for most of the remaining decade, per CoStar.

Even the normally ebullient, such as Vornado’s Steve Roth, are painting a stormy picture:

“We are now approaching the eye of the economic storm, and I expect it will get even worse. The Federal Reserve is doing its job as an inflation fighter and interest rates and the stock market are re-rating, the economy is slowing and layoffs are beginning. In this cycle, CBD office towers, nationwide, are the common enemy…How long and deep this all goes is unknowable and so liquidity is the main event.”

-- Chairman’s Letter, 4/7/2023

“We think the value is there. We think it's -- by the way, I'm not calling a bottom.”

-- Vornado 1Q23 Earnings Call, 5/2/2023

Yikes. It’s rare to find a bull for New York Office these days, and Steve Roth seems unwilling to buck the crowd publicly. However, behind closed doors, Roth and Vornado are acting a little differently.