Aritzia: Store Expansion Story at a Discount

Aritzia is one of the companies I've followed for a long time. I've been a shareholder for a few years, and the recent sell off looks like an opportunity.

Fabricated Knowledge subscribers - if this is the first time you’ve seen this email, don’t fret! You opted into the “everything else” column, and I’m spinning my everything else section into its newsletter - this one! I want to write about not-semiconductors; this is my first post about Aritzia.

Please note that this newsletter is not investment advice. The information provided is for informational purposes only and should not be considered as investment advice. It is recommended that you consult with a financial advisor or other professional to determine your investment goals and risk tolerance. Any investment decisions you make are solely your responsibility.

Aritzia is another iconic Vancouver-based brand going international. You’ve heard of Lululemon, you’ve heard of Arc’teryx, but have you heard of Aritzia? The story is compelling, and I think the outcome and upside to shares will be meaningful.

Aritzia, in many ways, is the iconic Vancouver brand. Lululemon went on to change the world as they sold yoga pants globally, but Aritzia is a homegrown hero with impressive store unit economics to count. I want to start this write-up with my favorite anecdote about this company, the annual boxing day sale. They focus on full price and rarely discount, so the annual boxing day sale is big.

On December 26th, the day after Christmas, an annual migration of women occurs across Canada. That migration is the flocking to Aritzia on boxing sales, and the lines are called a “Vancouver culture experience.”

One shopper arrived at 6 am to be 3000th in line. That’s brand loyalty. The real question is can that almost religious brand experience travel internationally? I think the answer is yes. Aritzia is one of the better brands in the women’s apparel landscape and has a strong unit store growth story. Aritzia has been quietly growing sales and brand recognition, and it’s now time for the big time, the United States.

I will write about Aritzia and why it’s a good investment now. The investment thesis is simple. Shares have sold off; this is a Growth at a Reasonable Price (GARP) story.

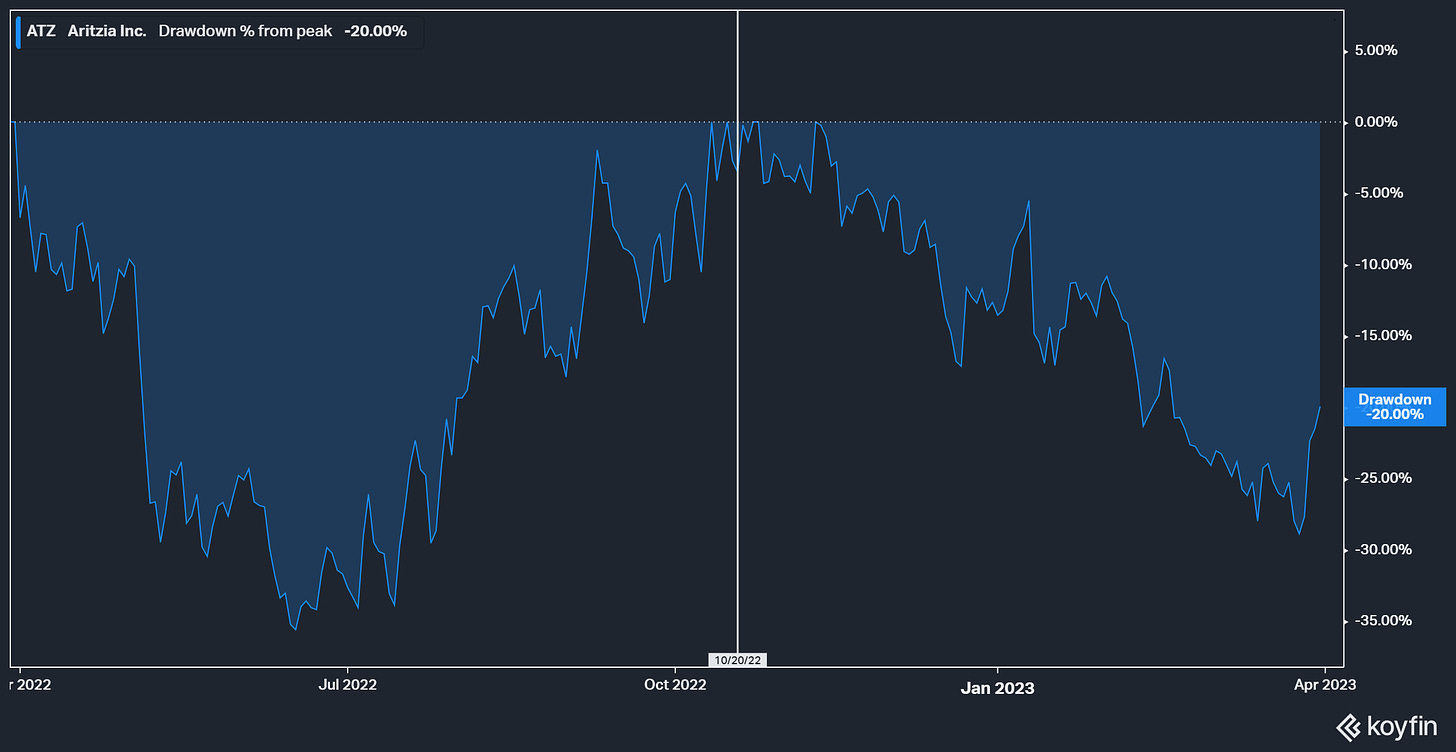

The opportunity exists now because shares have sold off on fears of a recession and the lack of international expansion during their Investor Day. Shares got excited into the Investor Day and have since sold off.

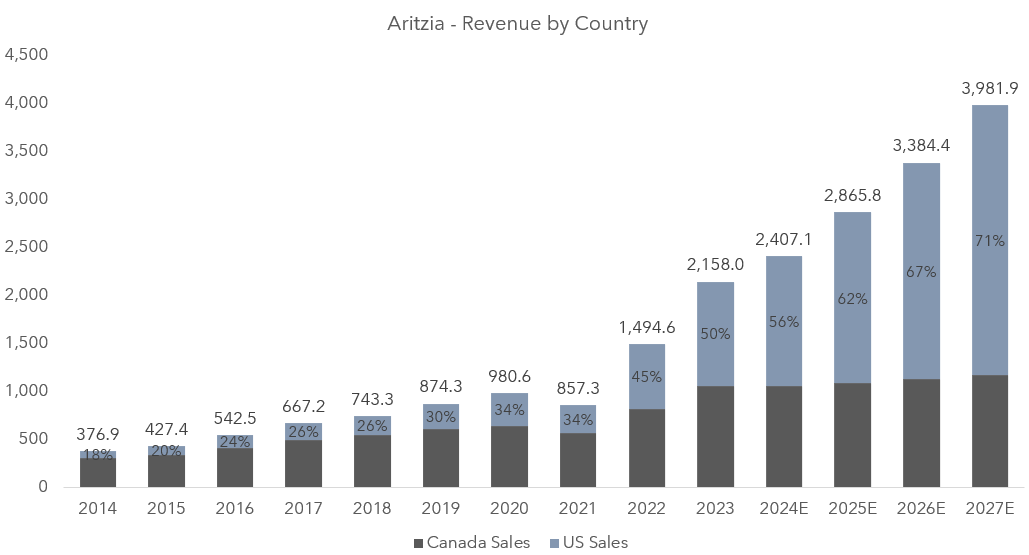

That’s the opportunity for a long-term investor. Aritzia is a leading and timeless women’s retail brand with excellent unit economics and a clear unit expansion story. The US and Canada are similar, and the expansion story is not “risky” as the US is already 50% of sales business. It’s now just up to Aritzia to execute.

I believe:

Revenue will grow at a 17%+ Revenue CAGR over the next three years, driven by an annual 8-10% expansion in space and an 8-10% same stores sales comparison on that bigger foot space. This compares to a 3/5/10 year revenue CAGR of 30%, 24%, and 20%.

As they expand stores into the US, Aritzia’s margins increase. E-commerce (38% of sales) and US stores (~50% of sales) are gross margins accretive. Markets with an Aritzia store increase e-commerce sales by 80%. The margin increase happened for Lululemon when they also expanded into the US.

Aritzia has a special culture and long-term focus lacking in public markets. In 2008, they invested in overhauling their ERP during the downturn. In 2020, they continued to expand stores during the pandemic, leading to even better unit economics as they grabbed flagship locations for cheap.

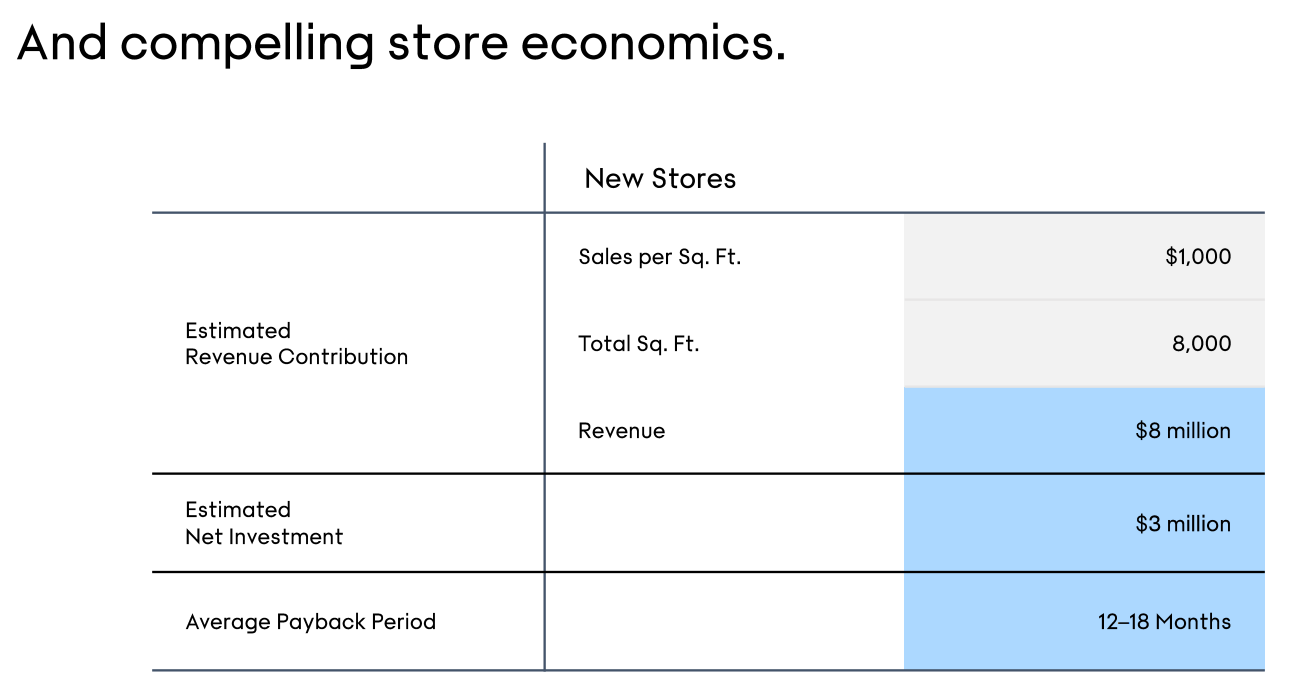

Aritzia is trading at a discount to the United States listed store count growth stories, FND, FIVE, OLLI, ULTA, and LULU. Aritzia has the best in-class payoff periods. Aritzia pays off new stores in 12-18 months, but every store in the last two years has been ahead of that payback period.

By having multiple brands, they have a license to reinvent themselves repeatedly. The Super Puff is a material amount of sales and was only introduced in 2018. Aritzia is timeless and offers high-quality clothes, at premium prices, for an Everyday Luxury experience.

Shares have been punished by fears of a recession and the lack of an international store expansion. The latter will come in time, but Aritzia has grown sales consistently every year except the fiscal year 2021 (ending March 2021), when the entire world shut down its stores. Even then, Aritzia only shrank revenue by 13%. Even during a recession - Aritzia will grow.

Aritzia’s multiple is undemanding and trades at 20x earnings and 10x EBITDA. I believe the fair value of a DCF is 20-30% higher, and shares could double over the next three years. Aritzia trades at a 40% discount to peers despite a faster growth profile, and an eventual US listing could lead to a re-rating higher.

Aritzia, the Other Vancouver Brand

This write-up will inevitably have a lot of mentions of the other successful Vancouver brand, Lululemon. In many ways, I will model Aritzia’s expansion into the US as a less aggressive but helpful guide to understanding Aritzia’s potential store count at maturity. What’s easy to understand is that Aritzia is a small brand getting bigger, and this is their clear moment.

The comparison to Lululemon might feel aggressive. I’m cognizant of pitching anything as the next Nike or Lululemon as likely a terrible thesis because each company is different. But the comparisons are apt to Lululemon, partially because their Canadian businesses are almost similar, and their store count is similar in Canada. Aritzia is now crossing the chasm to the US and has been wildly successful.

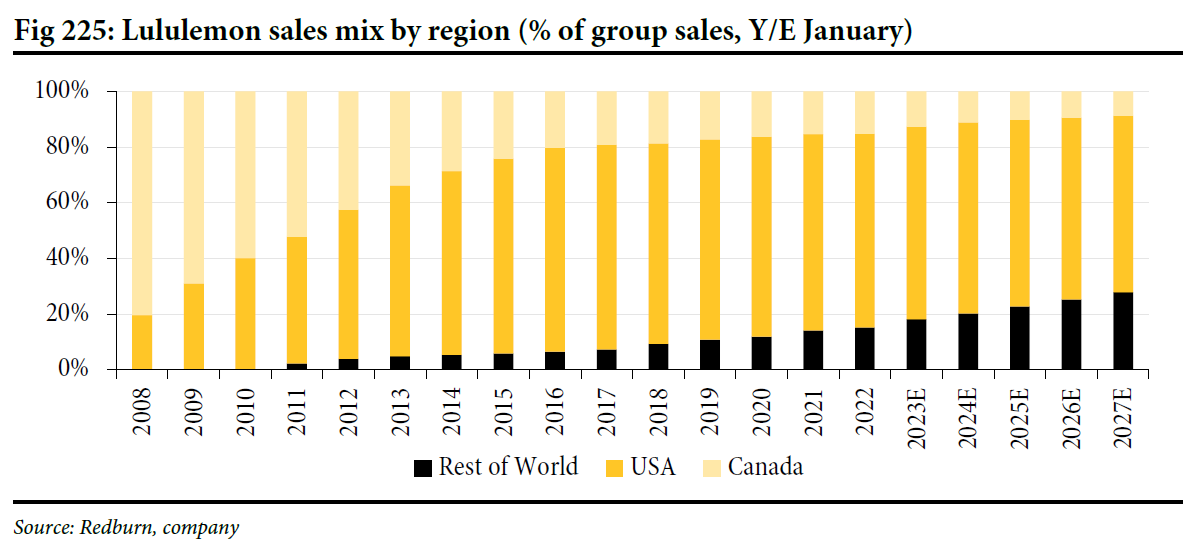

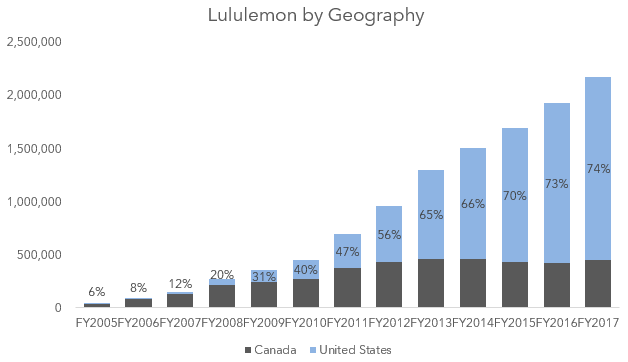

Aritzia is at a fabled moment in history, the legendary crossover of US and Canadian revenue. Lululemon made this crossover in 2012 (chart below), and Aritzia is now in that same place. Aritzia will not expand stores quite as quickly as Lululemon, but their history of sustainable and thoughtful growth means they have a long runway ahead of them.

What’s more, the expansion internationally will be margin accretive. The US stores have much higher sales per square footage, leading to better margins. Additionally, each time a store opens in a new market, e-commerce sales tend to increase in that new market by over 80%. This is a clear virtuous cycle in expansion.

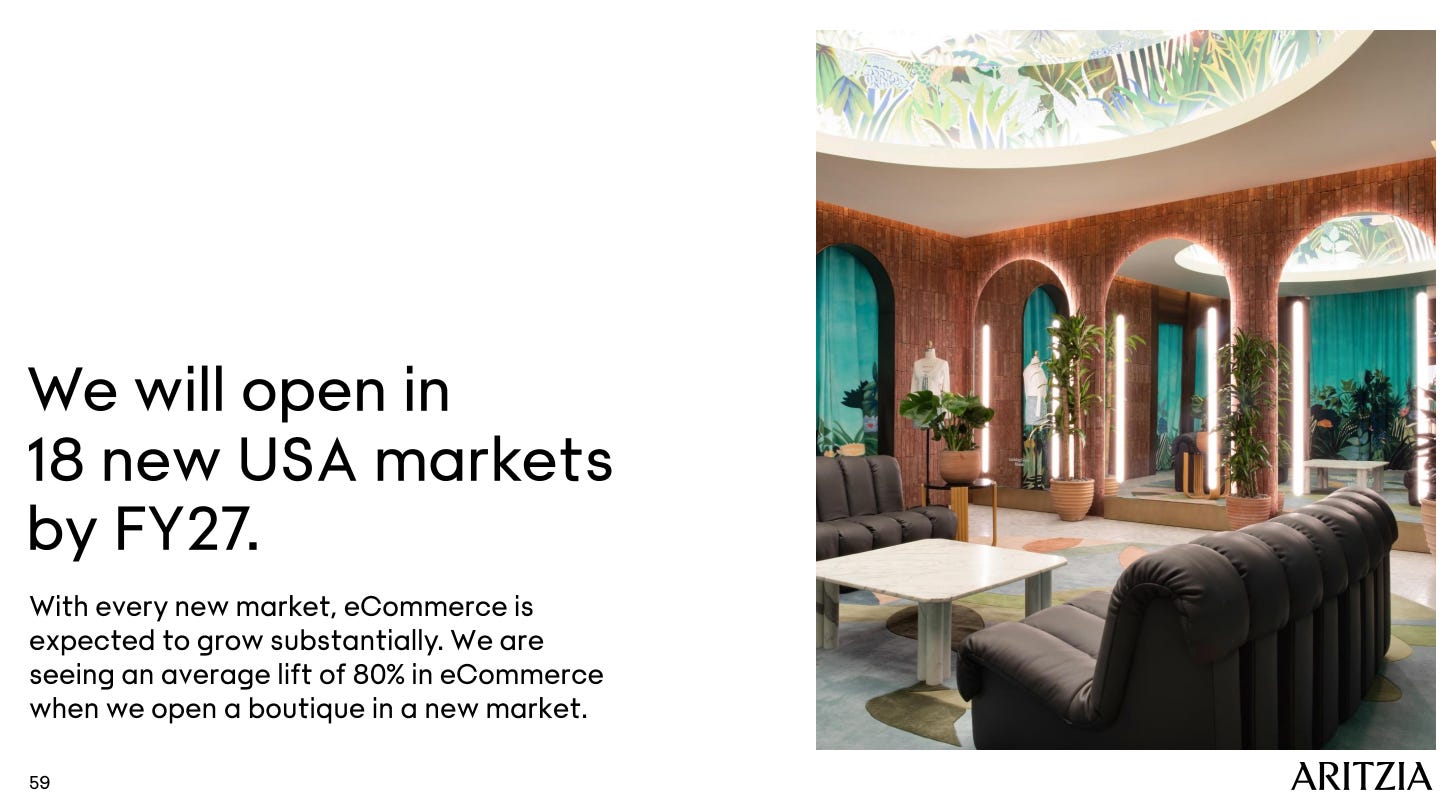

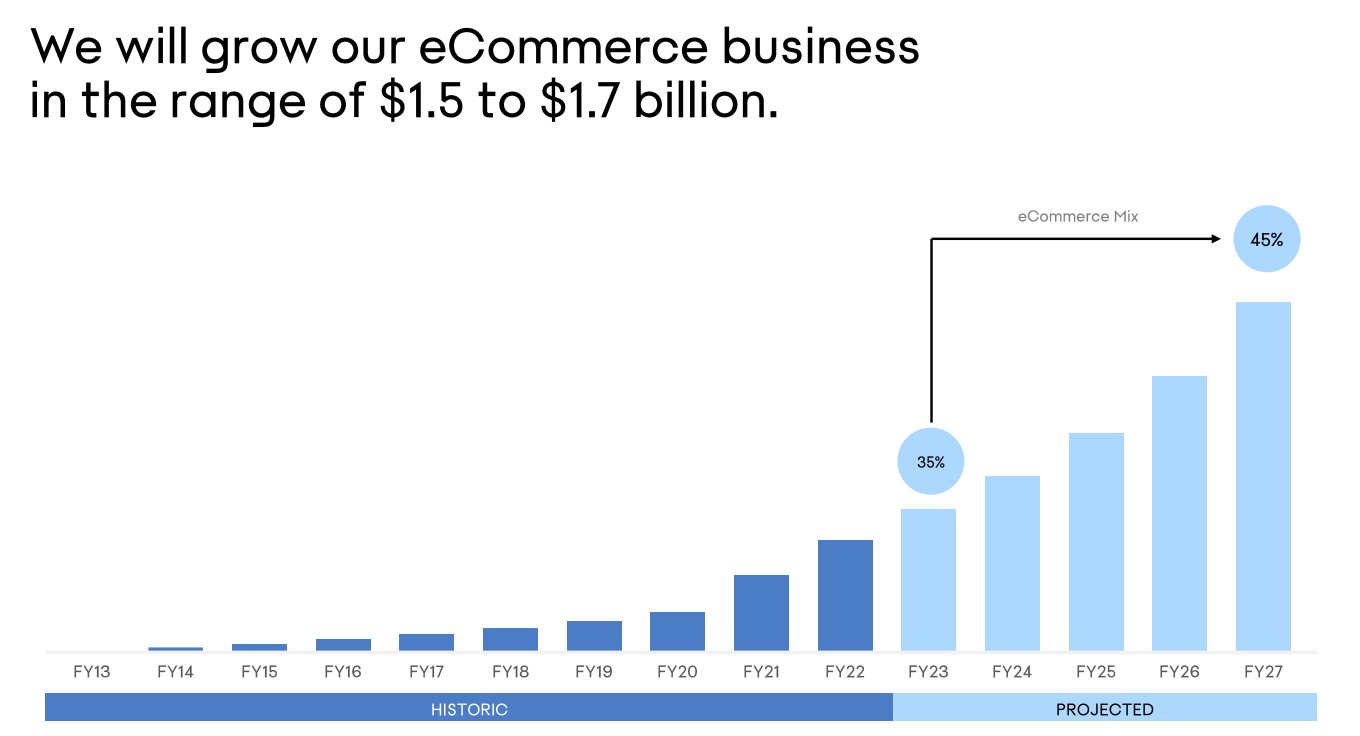

New stores have compelling unit economics and increase e-commerce sales in that market. Both come in at higher than corporate average margins. They expect to enter 18 new markets in the US (geographic locations) and clearly can do more over time. Meanwhile, their compelling store economics can be seen below.

They have been materially ahead of the 12-18 month payback period as they expanded into marquee locations during the pandemic. They could invest for the long term when others could not. Aritzia is debt free and is self-financing its expansion.

Higher e-commerce is an important part of this story, and they already have best-in-class e-commerce with 38% of sales in FY 2022. New stores creating awareness will increase repeat e-commerce purchases.

What’s more, the penetration of stores in the US seems paltry. Lululemon has ~300 stores in the US, and the 2027 guidance for Aritzia gets Aritzia to ~80 stores. While 300 is out of the question, 100-120 stores seem very doable for a company with its economics. I believe that Lululemon’s clear and successful expansion into the US will be repeated. Below is Lululemon’s storied expansion into the United States

I think Aritzia will repeat this.

Notice that the estimates are way more conservative, and that is partial because Aritzia itself is conservative. The store expansion opportunity will be important for their revenue to cross into the mainstream. But it’s not like this is a risky bet, as Aritzia’s stores are already hyper-successful concepts. Aritzia is already doing ~23 million a store in the US, including amortizing the startup costs of new stores.

I think that their measured pace of expansion means that it’s more likely Aritzia will not falter and will continue to grow. Something that’s underappreciated is by keeping a consistent portfolio of only AAA retail properties; they don’t have many closing costs and can support their distribution network with consistency. I think the US expansion will be a slam dunk.

I will leave the rest of the write-up (and valuation) behind the paywall. For a DCF, comps, and other valuation metrics that are the core of this thesis, refer to behind the paywall.